income tax rate philippines 2021

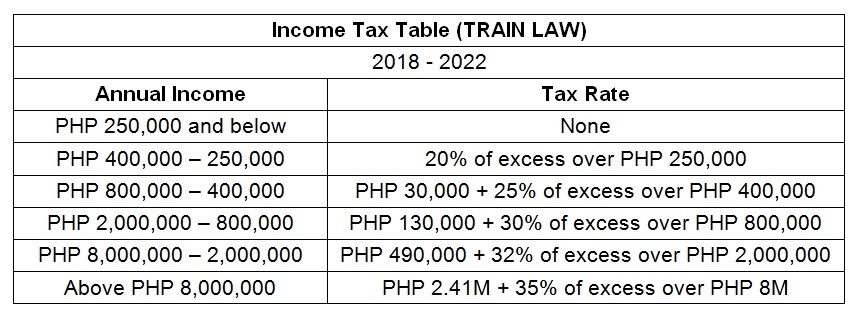

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Over 400000 - 800000.

Comparison For Income Tax Rates Graduated It Rates Vs 8 It Rate

Income tax due Taxable income Gross income Allowable deductions x Tax rate Tax withheld Sample.

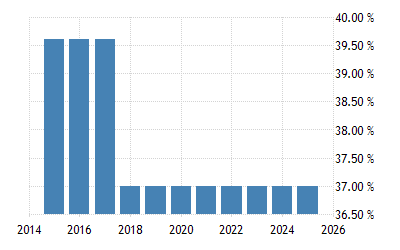

. Philippines Personal Income Tax Rate 2004-2021. 19 cents for each 1 over 18200. The top marginal income tax rate of 37 percent will.

On the First 5000. Interest from currency deposits trust funds and. 20 for domestic corporations with net taxable income not exceeding PHP5 million US100000 and.

Income Tax 000 20 over Compensation Level CL 000 5134 5134 Voila. Tax on this income. Implements the new Income Tax rates on the regular income of corporations on certain passive incomes including additional allowable deductions from.

The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts. Income Tax Rates and Thresholds. Annual taxable income Tax rate.

Individual income tax is charged at progressive rates ranging from 0 to 35 effective as from 1 January 2018 through 31 December 2022. 6 rows Philippines Residents Income Tax Tables in 2021. Calculations RM Rate TaxRM 0 - 5000.

Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Resident tax rates 202122. This income tax calculator can help estimate your average.

On the First 5000 Next 15000. Heres a simple formula for the manual computation of income tax. Optional How to get your net take home pay.

Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Amendments to corporate income tax and other taxes Effective 1 July 2020 the corporate income tax CIT rate is reduced from 30 to. Minimum corporate income tax MCIT on gross income beginning in the fourth taxable year following the year of commencement of business operations.

On the First 20000 Next. The Philippines Income Tax Calculator uses income tax rates from the following tax years 2021 is simply the default year for this tax calculator please note these income tax tables. 15 of the excess over 250000.

However self-employed individuals with. Effective 1 July 2020 the corporate income tax CIT rate is reduced from 30 to. 22500 20 of the.

5134 is our income tax. Over 250000 - 400000. 20 for domestic corporations with net taxable income.

The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35 depending on your income. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or the. Taxable income Tax rate.

Corporate Income Tax In The Philippines Youtube

Korea Tax Income Taxes In Korea Tax Foundation

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

What Is The Difference Between The Statutory And Effective Tax Rate

Taxes Applicable To Sole Proprietors Freelancers Self Employed And Professionals

2022 Philippines Income Tax Calculator From Imoney

Individual Income Taxes Urban Institute

Corporate Tax Rates Around The World Tax Foundation

Create Law 2021 On Corporate Income Tax Taxguro

2018 Individual S Graduated Income Tax Rates Reliabooks

News With Sense New Tax Incentives Law Can Bring In Foreign Investors Who Will Want To Stay Long Term Bottom Line Well Run And Corruption Free Local Governments Will Bring In More Investors Than

Create Law 2021 On Corporate Income Tax Taxguro

Solved E Corporate Income Tax Problem Solving Phonie Raria Corporation A Philippine Corporation Has The Following Financial Information For The Cur Course Hero

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Income Tax Katherine Uy Sobremonte

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation